What Is Take Profit In Forex

A Take Profit society is a type of society set up together with Market Execution or Awaiting orders. Information technology is used to fix profits one time the price level reaches a predefined value. Have Profit orders are executed automatically. This review deals with Take Profit orders and teaches you to identify them on unlike platforms, use them in various trading systems, and summate their levels.

The commodity covers the following subjects:

- Basics of a Accept-Profit Gild

- How Take Turn a profit works. Take-Turn a profit Order Example

- Accept Profit Computer

- How to gear up Have Profit on LiteFinance's platform

- How to ready Have Profit in МТ4 / MT5

- How to set up Accept Turn a profit in Quik

- Where to set Take Turn a profit?

- Take Turn a profit strategies

- Pros and Cons of TP Orders

- Accept Profit FAQ

Basics of a Take-Profit Order

There is Take Profit definition:

Take Profit (ТР) is a pending social club that directs the broker to close a trade in one case the nugget's price becomes equal to the value preset by the trader.

Let me explicate the Take Profit significant:

Information technology works equally follows: the trader places an gild to buy and buys an asset at its current price on the trading platform. He also sets a TP value at the current price + 20 points in the order. In one case the price level reaches that value, the trade will be closed automatically. A TP order remains active until the price reaches the preset value.

The trader can place TP orders in the following situations:

-

To open a merchandise if the trader is absent. For case, y'all suppose the price will reach a necessary level at night, but it might then accept retraced to the previous level by the morning. And then, you gear up Take Turn a profit and go to bed. The trade will be closed automatically upon reaching the predetermined level. In the morning, you take your trade closed with profits.

-

To shut a trade upon touching the level. This technique is often used in scalping, where even milliseconds affair. The trader supposes that the price line will reach a certain level and and then pull back. He or she understands that closing a position manually might take too much time, and the toll might go in the reverse direction too quickly upon touching the level. So, a Have Profit order is ready to exit the marketplace with the most profit, and a position is closed automatically in one case the toll touches the predefined level.

-

To observe a risk management policy and trading psychology. Emotions and greed can urge traders to go on profitable trades in the marketplace longer in the hope of higher profits. As a consequence, the trader misses a cost reversal moment and closes the trade at a less attractive price. Likewise missed profits, some traders feel bad almost that. Take Profit orders do cut down prospective earnings, merely they also protect you against reversal risks and reduce tension.

In the Forex market, Have Profit orders are always placed above the Bid toll for long positions and below the Inquire price for brusque positions.

Attention! In that location are two prices in the market place: Bid — sell price, and Inquire — buy price. The Enquire price is always higher than the Bid price. Candlesticks are formed as follows:

- Loftier is the maximum Bid over a certain menstruation.

- Depression is the minimum Bid over a certain period.

And then, Min Enquire volition equal Depression plus spreads, and Max Ask will equal Loftier plus spreads.

- When ownership, Take Profit is triggered when the Bid price reaches the preset value.

- When selling, Accept Turn a profit is triggered when the Inquire price reaches the preset value.

The platform's charts display only the Bid price as a default parameter. Call up to price in spreads when setting your TP social club.

How Accept Turn a profit works. Accept-Profit Order Example

A TP market society can work automatically at the preset level without the trader'due south participation.

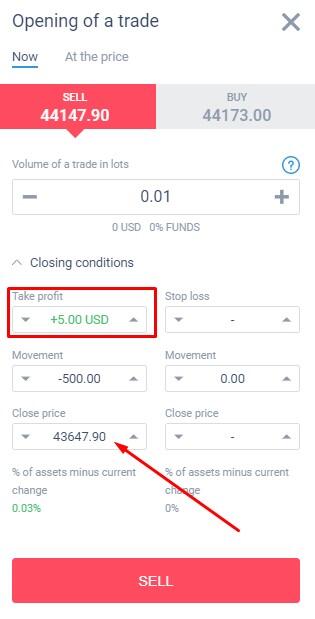

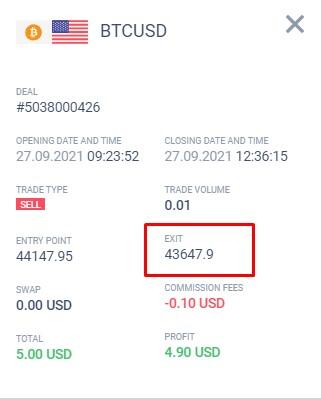

How does Take Profit work? Hither's an example. Open the BTCUSD'south chart. Equally our goal is to come across a have-profit club example, we'll take a short M5 time frame. Open the society window and set a target turn a profit amount at 5 USD, which corresponds to 43,647.xc.

Open the trade. Wait for the price line to reach the predefined level. The merchandise volition close automatically upon reaching the TP value. Click on the trading history tab and check the closing cost.

It is identical to the cost specified in the order. That means the merchandise has been closed automatically without delays or slippage by the trader'due south guild.

Take Profit Reckoner

A Forex Take Profit Figurer is a tool that automatically calculates the TP club amount based on the Stop loss amount, opening cost, and the % of trades closed by TP/SL limit orders. In its turn, a Stop Loss level is calculated according to the take a chance management policy — trade volume, trade value, etc.

Example. A trading strategy results in 70% of loss-making trades closed by Cease Loss and 30% of profitable trades airtight past Take Profit. Thus, we have:

0.vii * Loss > 0.3 * Profit

Nevertheless, for a trading strategy to work, the eventual total loss must be less than total turn a profit. Thus, Accept Profit must be at least 2.33 times (0.vii/0.3) bigger than Stop Loss. Eventual slippages considered, the value should get up to ii.five times.

Employ Trader's figurer to make up one's mind the best level to place take profit at:

How to set Take Profit on LiteFinance's platform

Attention! At that place are many strategies on the internet where TP and SL amounts are calculated for 4-digit quotes, and some calculators do that as well. For case, similar on the site of Investing. At LiteFinance, the values are calculated for 5-digit quotes.

Here'south a guide to setting a Have Profit gild on LiteFinance'southward platform for beginner traders:

one.Register and open a existent or demo business relationship. Just click on "Registration" on the dwelling house page and follow the instructions. If you are registered, click on "Login" and enter your login data.

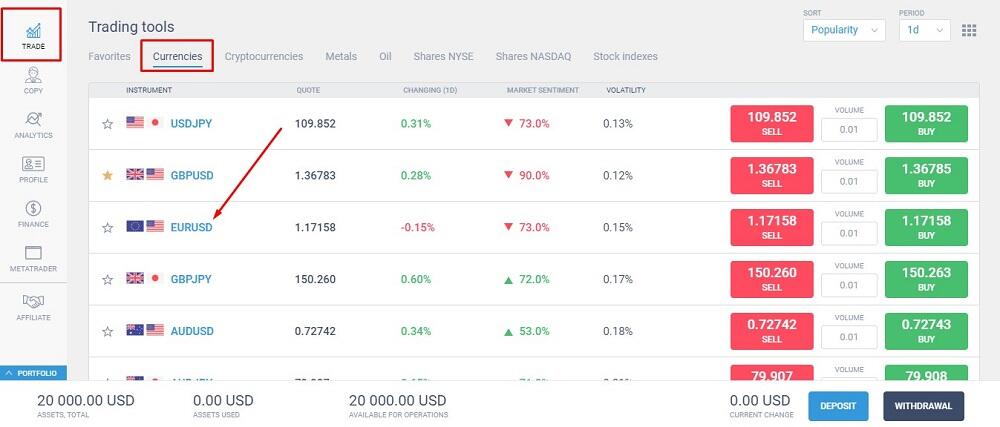

2.Click on "Trade" in the vertical carte on the left and cull your asset from the horizontal carte du jour.

iii. Click on "Closing weather" to the correct of the chart. Or, if your nautical chart is extended, click on "Open up trade" in the upper right corner and and so click on "Closing conditions."

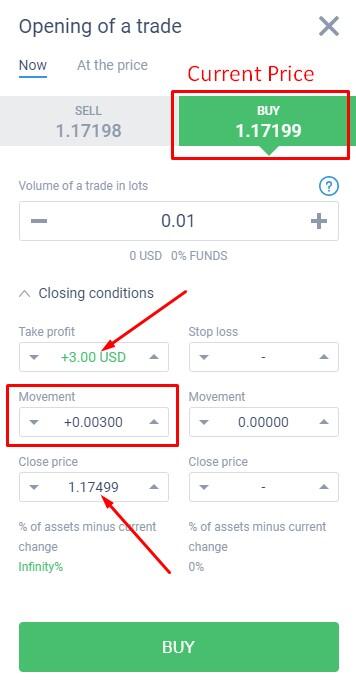

You'll encounter two columns in the window that opens: one is for TP values, and the other is for SL values. The Take Profit column has 3 fields:

-

Take profit. Here you can set a TP value in USD. For example, you want to make a trading turn a profit of xx USD. Then, yous enter that value in the field. Recollect to permit for spread.

-

Motility. Here, yous can enter the number of TP points. For example, you wish a TP gild to trigger once the toll covers a distance of 30 points (for 4-digit quotes). The screenshot shows a Buy social club. So, nosotros need to enter "0.00300" in this field.

-

Close price. Here, you tin can enter a value the quote must attain for a TP order to trigger. Add 30 points to the opening toll of 1.17180 and enter the value you lot go — 1.17480 — in this field.

When you're setting one of the values in any field, the residual of TP values are automatically shown in respective units in the other 2 fields.

Example. You wish to set a TP value of 30 points in the "Movement" field. That equals 300 points for 5-digit quotes. Then, you'll take the following values in the other two fields:

-

Take profit — three USD. In this case, we're opening a position of 0.01 lots in the EURUSD. I point cost is 100,000 * 0.01 * 0.00001 = 0.01 or 1 cent. 3 hundred points — 300 cents or 3 USD.

-

Shut cost. Iii hundred points volition be automatically added to the trade's current opening price.

To modify a TP value for an open up position, click on "Portfolio" so on "Edit."

How to set Have Profit in МТ4 / MT5

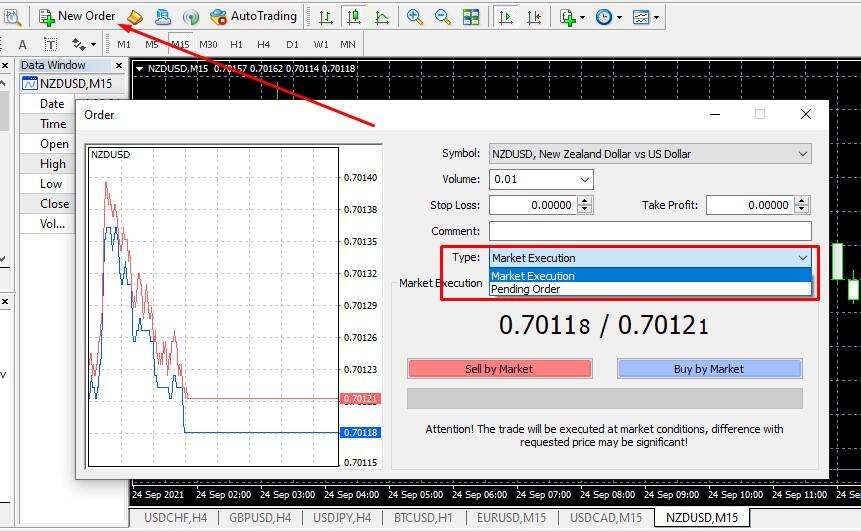

The principle of setting TP orders in metatrader is identical to the TP setting on LiteFinance'southward platform. It can exist set at the moment of trade opening, or you can modify an open up position. Y'all tin can also motility a TP order correct on the chart without opening the club's window.

How to set Have Profit for a long trade?

one. Click on "New order" on the chart. Choose a market execution gild or a pending social club — you can ready a TP order merely as an add-on to those ii types of order.

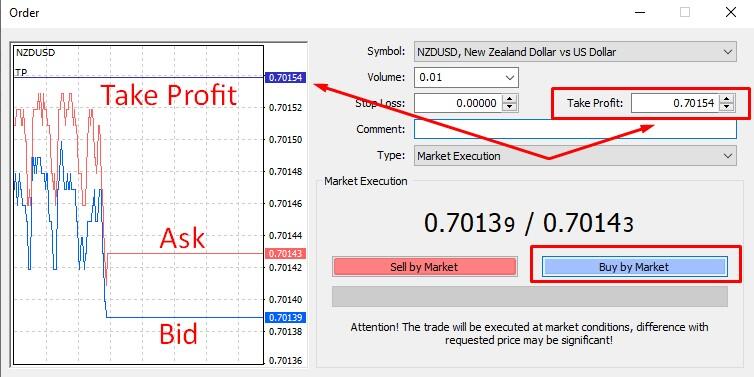

ii. Enter the level on which a long position must be closed in the Take Profit window. A TP level must be more the asset's electric current price. A position to buy is opened at the Inquire price, the higher price marked as a red line on the chart.

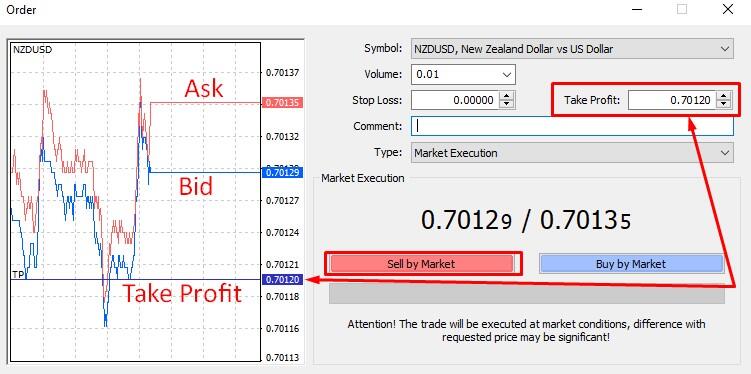

How to set Take Profit for a curt merchandise?

The procedure is identical to the previous ane. The difference is that a short position is e'er opened at the Bid price, and Have Profit is always set beneath it.

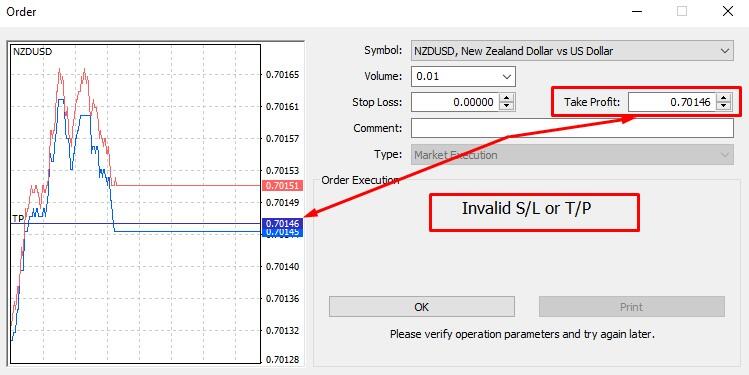

If you try to set your TP order between Enquire and Bid values, yous'll take a system message that the TP value is incorrect and can't, therefore, be gear up.

How to move Have Profit for a long position in MetaTrader

2 horizontal dotted lines are displayed on the nautical chart after you open a trade in MT4.

i — opening price level;

2 — TP level (for a long position, in the example higher up).

You can open equally many orders every bit you wish on one chart. Not to misfile TP orders for different trades, the order number is indicated above the dotted lines, on the left.

There are several ways of moving Take Profit:

-

Put the cursor on the TP horizontal line and drag information technology to a new place.

- Modify your gild. Click on "Trade," correct-click on the order and click "Change."

You can motion your TP order only in compliance with trading rules. You lot cannot set your TP level below the opening price for a long trade and above the opening price for a short trade.

How to set Accept Profit in Quik

The procedure is identical to MT4. Specify "Take profit" as a blazon of stop club in the window for order setting and enter your value in the window that opens. In contrast to MT4, Quik sets Have profit as an contained order. So, you demand to specify your trade size, type of asset, client's code, etc. You can also ready Take Turn a profit in Depth of Market (orderbook).

Where to set Have Profit?

How to set Take Profit correctly? TP calculation methods are subdivided into mathematical and graphical. The subdivision is conventional, and it would exist difficult to say which method is ameliorate as much depends on the market place situation. Nosotros'd better learn to use all of them.

1. TP setting based on cardinal levels. Resistance and support levels are the areas where the trend is most probable to modify its management. The price will probable achieve one of such levels, but whether or not it will break it out is unclear. TP orders fix profits before the price pulls back.

Such levels emerge due to psychological reasons. For example, most investors place TP on the level from which the price pulled down in an uptrend last time. TP is an order to sell. So, when all the orders to sell are triggered simultaneously, the price stops growing.

Instance :

The H1 chart displays a long downtrend with frequent deep corrections. 3 points allow drawing a horizontal level, which first serves equally support and and then as resistance, two times. One of the bulls' attempts to interruption it out from below is unsuccessful. A new ascending correction has developed recently. It might end on the trend line or the resistance level. Those two points can thus be used for setting a TP terminate order.

two.TP setting based on volatility. You demand to know the candlestick's average size that will determine price fluctuations on a smaller TF nautical chart.

Example. The boilerplate size of an asset's daily candlestick is 80 points in iv-digit quotes. The price has covered 30 points within 5 hours since the mean solar day opening on the H1 chart. That means it will accept covered at best 50 more points within the rest of the twenty-four hour period, and setting TP higher is unwise.

Useful articles on volatility:

-

Average True Range Indicator: better your trading with volatility measure out.

3. TP setting by use of Fibonacci retracements

Correction levels are useful in swing trading strategies and short-term trading systems. Their underlying idea is that the price gets back to its previous levels and continues following its main trend later a market correction. A trade is opened at the correction bottom later a reversal clearly manifests itself. A TP order is fix at the next level or the correction's beginning.

Instance :

The Fibonacci grid is fatigued through extremums Fibo 1 and Fibo 2 in an uptrend. Correction goes to level 0.382 and almost touches it. In contrast to the previous candles, the ruby ane has a pocket-sized body and equal shadows in both directions. That's a sign of a reversal. Open up a trade on the current or next ascending candlestick. Set Accept Profit on the correction's starting time level — 0 every bit per Fibo filigree.

When information technology comes to long-term trading strategies, employ Fibonacci Extension. For more details on how to use indicators, bank check our review What is Fibonacci retracement? How to trade using this indicator?

4. Time-based TP setting. This style of setting Take Profit is advisable to intraday strategies. Non to pay swaps, Take Turn a profit tin be gear up one hr before the day'south closure, for case. If the price fails to reach information technology, the merchandise is closed manually. This approach can also be used in news trading, just earlier of import publications are released.

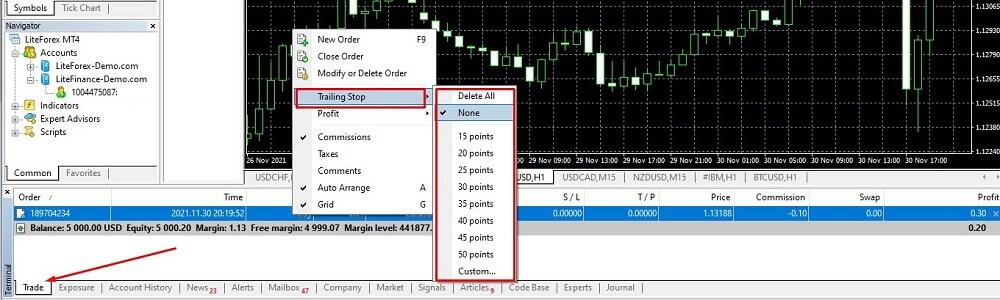

5. Using Trailing Stop. That is a blazon of protective finish-loss order, and it often replaces Take Profit limit order. Different TP, Trailing End doesn't shut a profitable trade. Information technology follows the price at a predefined distance and stands withal when the market price reverses.

The screenshot below shows how to set Trailing Stop.

A situation where several levels are superposed is chosen "Confluence". If a strong level coincides with Fibo levels or a mathematically calculated point, that's a good TP level.

6. TP setting based on goals or mathematical calculations.

Trading should yield profits comparable to other alternative profit-making methods. If your goal is to earn 100 points in a twenty-four hour period, TP for one trade should be 100 points, TPs for two trades should be 50 points each, etc. Once you hit your initial goal, you can relax and trade without TP orders, protecting your trades with Cease Loss to a breakeven level. The disadvantage of that method is that y'all don't know the trend'south exact extent. The price might not brand it to a far TP goal. Or, on the contrary, a Take profit guild might close your merchandise likewise early when the trend is your friend.

A mathematical approach suggests considering a TP/SL ratio. First, yous calculate your stop-loss size based on position amount, leverage, i point cost, and take chances of losing money per merchandise in relation to your deposit size. Then, you calculate a TP amount. The most pop ratios in trading are three/i and ii/1. Accept Profit should be two-three times bigger than Finish Loss. That theory is mathematically based, but you shouldn't stick to information technology strictly.

Here's some communication on TP setting:

-

Don't endeavour to cash in on the whole trend. No one can say for sure when a trend will reverse. Locking in at least 60% of profits will be a good outcome.

Instance. You lot "defenseless" the beginning of an uptrend. Having plotted resistance levels and analyzed longer time frames, y'all've concluded the price might rise by 100 points approximately. In that instance, y'all'd rather gear up your TP at 60 points, not at 100 points. Or, you tin close half the trade manually once you make l points and protect the rest with Trailing Terminate.

-

Don't place your TP order exactly on the central levels: there can exist many other traders' orders as almost people are inclined to stereotypical thinking. If your TP order is farther than near of the other TP orders, the price might reverse earlier than your order is triggered. Set your Take Profit below the cardinal level for long positions and above the fundamental level for short positions.

Take Profit is an order given to the broker, and it must exist executed. A trade must close automatically in one case the cost reaches the level set in a Take Turn a profit order. However, at that place can be applied situations where a trade closes at a worse toll, or the order isn't triggered.

The reasons for that are as follows:

-

The absence of opposite book required to execute the merchandise at a given price. For example, you lot take bought one lot and wish to sell it at a higher cost. When the price rises to the predefined value, no one wishes to buy one lot from you. So, the cost tin go down immediately later on touching the level. The broker doesn't know what to practice next: it tin wait for a new buyer who wants to buy one lot. Information technology tin sell a portion of your merchandise. Information technology can request you for information on what to do. Such a situation is chosen "requote." Types of order execution are determined past the trading platform and the broker's trading terms. For instance, МТ5 provides the following execution types: Fill or Impale, Immediate or Cancel, Return.

Check our review Difference betwixt MT4 and MT5 – What is Improve for more details on social club execution types.

-

The trader confused Bid and Ask prices and forgot nigh spreads. "I opened a short position, the price went three pips lower than my TP, and it wasn't triggered. Why?"

Suppose yous opened a position in the EURUSD at 1.17160 and fix TP at 1.17110. A trade to sell is matched by a trade to buy, at the Ask price. The Ask price is e'er higher than the Bid cost on the chart if the chart displays the Enquire price. As a default choice, charts display but the Bid toll. The minimum Ask toll equals the Bid price plus spread. If the spread is three pips, Bid must be 1,17107 for the merchandise to close at 1,17110 (Enquire price). So, if your TP order is set at i.17110, the nautical chart will evidence the price'south fall (Low) by three pips (spread) below that level.

-

Trading conditions. Some brokers stipulate the following condition: a TP order is triggered merely if the price has been on the order'southward level for at to the lowest degree one second before it reverses. Otherwise, the order isn't triggered.

-

Gaps. Take Profit orders might fail to work if a gap occurs. If they piece of work later a gap, that will be in the trader's interests. If they don't work at all, the trader should ask his/her banker why.

-

Technical issues. Those are a broker's error in 99.9% of cases. Brand screenshots when setting an order and contact the broker's support team.

If you have already faced the wrong execution of limit orders, leave a comment, and we will look into information technology together.

Take Turn a profit strategies

We have already examined what TP orders are and how they are calculated and attack LiteFinance's platform, МТ4, and QUIK. Next, we will take a wait at two practical strategies of using TP limit orders.

Trading with TP in the direction of the trend with plotting of key levels

The strategy is based on post-obit the tendency line. Support and resistance levels are used as auxiliary tools.

The order of actions:

-

We tin can see a downtrend and recurring corrections on the H4 chart. The S1-R1 segment could be a new uptrend, simply according to the Elliott Wave theory, at least three waves and two corrections must develop to put an end to the downtrend. There isn't plenty data to enter the market place in the uptrend.

-

The downtrend includes a highly volatile flat range. Plot L1 and L2 levels through support and resistance levels R1, R2, S1, S2, respectively.

-

The cost forms the Double bottom pattern, through which L4 level is drawn. By the time the pattern had formed, there wasn't any clear trend reversal signal. Though Double Bottom is a reversal pattern, that could be another flat segment. So, it's as well early to open up a merchandise.

-

An uptrend begins. Draw L3 level through local highs and lows. Open a trade if the trend line and L3 level are broken out.

-

L2 and L1 levels are target points for placing Take Profit. In the start case, the position would yield nearly lxx points in two-ii.5 days. In the second case — almost 185 points within nine days.

That's a long-term strategy, so consider swaps, also. It suits traders whose feel goes beyond basic noesis. The boilerplate daily profit is twenty-30 points. The chart should exist analyzed and controlled every iv hours. To form a fully-fledged trading system, add some tendency indicators to this strategy. For example, Alligator or moving averages.

TP setting by utilise of aqueduct indicator

In this strategy, a merchandise is opened when the channel is cleaved out. The TP corporeality is quite small here. The toll moves inside the price range nigh of the time. When the market place meets a crucial central factor or a big majuscule, the cost breaks out the channel limit and moves on under its inertia for a while. Nosotros can cash in on that marketplace reaction.

Initial data:

-

Fourth dimension frame: М15-М30. The marketplace inertia doesn't last for long, and using it in the brusque term is easier.

-

Financial instrument: whatever currency pairs.

-

TP amount: 30 points for 4-digit quotes. A TP limit lodge is placed using the mathematical method. Key levels are not important here. To make substantial profits, open a trade of at least 0.1 lots. An efficient trade should yield at to the lowest degree xxx USD.

-

Indicators: Keltner Channels and RSI.

The main indicate: the candle closes 50% beyond the channel limits. Confirmation signal: the RSI moves to the overbought or oversold areas for long or short positions, respectively, on the signal or previous candlestick. Open a trade and add together 30 points in the TP order window.

Example.

There's a bespeak to open a short position in both cases. The RSI moved to the oversold area, and the carmine candle closed outside the channel limits. Gauge TP levels are shown on the chart. Even so, as that'southward a clear downtrend, it would be wise to delete TP once information technology's triggered and protect the trade with Trailing Stop.

Bank check out our review Keltner Channel Indicator for more data on the strategy and the indicator.

Pros and Cons of TP Orders

Take Profit is a type of protective guild. If you need to be out, only set TP at the price level the cost will accomplish for sure in the future, and don't worry any longer. Profits volition be locked in automatically.

TP pros:

-

Yous tin can get out your trades uncontrolled for a while. TP orders are helpful in medium-term and long-term strategies. They are also appropriate to trading in several assets where the trader needs to control several charts.

-

Control over emotions. Yous don't know when quotes volition change their direction. When setting a Have profit social club, you can control your emotions so that greed doesn't have over. Thus, you won't miss something more than important while running after bigger profits.

Using TP orders is recommended to beginner traders. Take Turn a profit should be placed earlier opening a position and non corrected before closing a position. Every bit long as a merchandise isn't open up, the trader is more focused and cool-blooded.

TP cons:

-

Missed profits. TP orders close a trade, whereas it can continue yielding profits as the cost moves on in the predicted direction. Opening a trade again involves spread-related expenses.

-

Information technology's hard to utilize TP in scalping in the short term. Even seconds count in scalping. There'south no time and sense in placing TP orders as trades are almost always airtight manually.

-

It's hard to use TP orders during high volatility periods, for case, when central stats are released. A drastic cost fluctuation in either management can trigger a TP order placed too close. Opening a trade again involves spread-related expenses.

Have Profit orders are often used in M30-H1 strategies and tendency markets. Placing TP exterior flat ranges is rarer. An case of that strategy is provided in the review Sniper Forex Trading Strategy.

Pros and cons of Accept Profit

| Pros | Cons | |

| Profitability | It allows locking in profits automatically without trader's participation | It limits profits. The toll can keep moving in the right direction after the position is closed |

| Take a chance | It limits risks. Allows making profits when the cost touches the predetermined level before information technology pulls back | The trader might bear additional spread-related expenses when opening a position again afterward the previous ane has been closed by a TP order earlier than planned |

| Strategies | It is handy for trading several assets or using several strategies | Inappropriate to scalping strategies or before news releases |

| Emotions | Information technology makes you follow a strict plan. Excludes property a position open till the last while running after bigger profits | It might give rising to negative emotions equally the trader seems to miss profits |

Hope we figured out what is have turn a profit in forex and know why should we use it how to apply it correctly. If you have whatsoever questions, ask me in the comment section below.

Take Profit FAQ

That'due south a blazon of limit club that locks in profits without the trader'south participation when the price has touched the predetermined level.

You lot demand to specify your take profit corporeality in points or currency units in the merchandise's parameters or enter a specific toll if your platform provides all these options. A TP value shouldn't be between Bid and Ask prices. It should be higher when opening a long trade and lower when opening a short merchandise. A trade will be closed automatically once a TP value is reached.

- When yous think the price will achieve a sure level but don't have the opportunity to shut the merchandise yourself. For example, you lot're following some other charts or taking a rest at that moment.

- When the rules of your trading system, which you lot developed before investing, make provision for using TP.

- When you understand that y'all cannot always command your emotions. Information technology's amend to brand a partial closure of your trade and lock in profits than trying to make the nigh of the trend and so regret doing so.

If yous don't take enough feel, avoid running afterwards a huge profit.

Fractional Have Profit doesn't exist equally such. Take Profit is an boosted order that is ready together with Market or Pending orders and directs your broker to close the whole position automatically. Yous can close a portion of your trade manually by modifying the guild. To do that, you need to:

- Choose an order in the Merchandise tab and left-click on information technology twice.

- Choose the "Market execution" blazon of lodge in the window that opens.

- Modify your trade size by entering a portion of your trade to be closed. Confirm the changes.The remaining trade size volition be closed by the TP guild.

- Based on key levels. You tin can place TP a bit below the key resistance level for a long position and a chip above the key support for a brusk position.

- Based on volatility levels. The candlestick trunk size is determined using a estimator on a bigger time frame chart. The distance covered by the price in points since the beginning of the bigger TF candlestick is determined on a smaller time frame chart. The difference serves as a ground for computing your ТР limit order amount.

- Based on Fibonacci retracements. Take Profit is ready on the correction start level based on the correction grid. Or, Fibonacci extension is used.

- Based on trading hours. TP is set before swaps are paid or before central factors, such equally news or stats, are released. If the price doesn't attain the gild value, the trade should exist airtight manually.

- Based on Abaft Stop. Instead of setting TP, the trader can use Trailing Finish that follows the price in the forecast management and limits risks. The position is closed automatically with profits when the price reverses and touches the Trailing Stop level.

- Based on trading goals and mathematical calculation. Placing TP on the level that yields the minimum expected profits over a certain fourth dimension or based on the Take Turn a profit/Finish Loss ratio.

You lot need to change the merchandise size in the gild manually, endmost a portion of the position and keeping the remaining part in the marketplace.

These two orders cannot be gear up without other orders. They take opposite functions. TP closes a trade with profit when the price moves in the desired direction. Finish Loss closes a trade to limit losses when the price moves in the opposite direction of your forecast.

The content of this article reflects the author's opinion and does not necessarily reflect the official position of LiteFinance. The material published on this folio is provided for advisory purposes only and should not be considered every bit the provision of investment advice for the purposes of Directive 2004/39/EC.

Source: https://www.litefinance.com/blog/for-beginners/orders-market-limit-and-stop-buy-and-sell/take-profit/

Posted by: bojorquezstentartudge.blogspot.com

0 Response to "What Is Take Profit In Forex"

Post a Comment