professional trading strategies book live trader

To get winner in intraday trading, requires dedication, hard go, patience, prompt wit, and immense noesis. Successful day trading involves 10% murder and 90% patience. To increase expertise in day trading and to hone trading skills, it takes a fair quantity of time. On that point are a number of Unexceeded Intraday trading strategies available for trading, but the success or bankruptcy of the strategy completely depends on the market. Mayhap one strategy works in today's market condition, but May non works according to the close day's market specify. Not sole, the movement of the market, simply the intraday trading strategy also depends connected the trading styles of the trader. IT besides varies at different times of the day, depending upon how the market is behaving.

Here, in this blog, you will find Strong Day Trading Strategies, which you can economic consumption for intraday trading.

Intraday Trading Strategy #1. Newsworthiness Based

Newsworthiness based trading is the to the highest degree traditional form of day trading. This type of trader doesn't focus on on the stock price and volume charts, they waitress for selective information that wish push on the prices.

The selective information Crataegus laevigata come in the figure of a company announcement about earnings or new products; a general economic announcement or so interest rates operating room unemployment; or retributory a whole lot of rumors about what whitethorn or May not be happening in a relinquished industry.

Traders World Health Organization do good with news-based trading, unremarkably experience some understanding and cognition of the markets. This type of traders are not expert analysts Oregon fundamental researchers, but they have decent knowledge virtually what kind of news show would personify in-favor operating room what would be taken poorly by marketers. They also yield attention to a fewer different news program sources and also whenever they find the right opportunity, they point the order at the right metre.

The downside of newsworthiness trading is that thither may be some and far good events; more often, the hype is already built into the price by the time you watch IT. Many news traders turn to the scalp spell they wait for something to create a less excitement.

In front you start word-based day trading, one thing you should keep in mind that, this type of trading strategy is rattling wild as compared to other strategies. It also gives sharp returns on investment funds within a day.

Intraday Trading Strategy #2. Gap + B.B. (S20,2)

This strategy is useful when the stock/ Index opens Gap Up or Gap Down.

Subsequently the gap, the unoriginal shows a potential reversal sign, which can observe by the rate of a candlestick Beaver State aside weighty volume event. You can fade the action and go in the opposite word direction of the disruption with a profit target of the start of the gap.

# Know About : Bollinger Circle

Rules:

- Debut between 9:30 to 10:00.

- Exit at stop-loss Oregon at 3:25.

- Bollinger stripe strategy is 20,2

- 30- minute time frame is required.

- Big Profits and Modest losses.

- No need to trade every day.

- Helps to stay forth from the Sideway market.

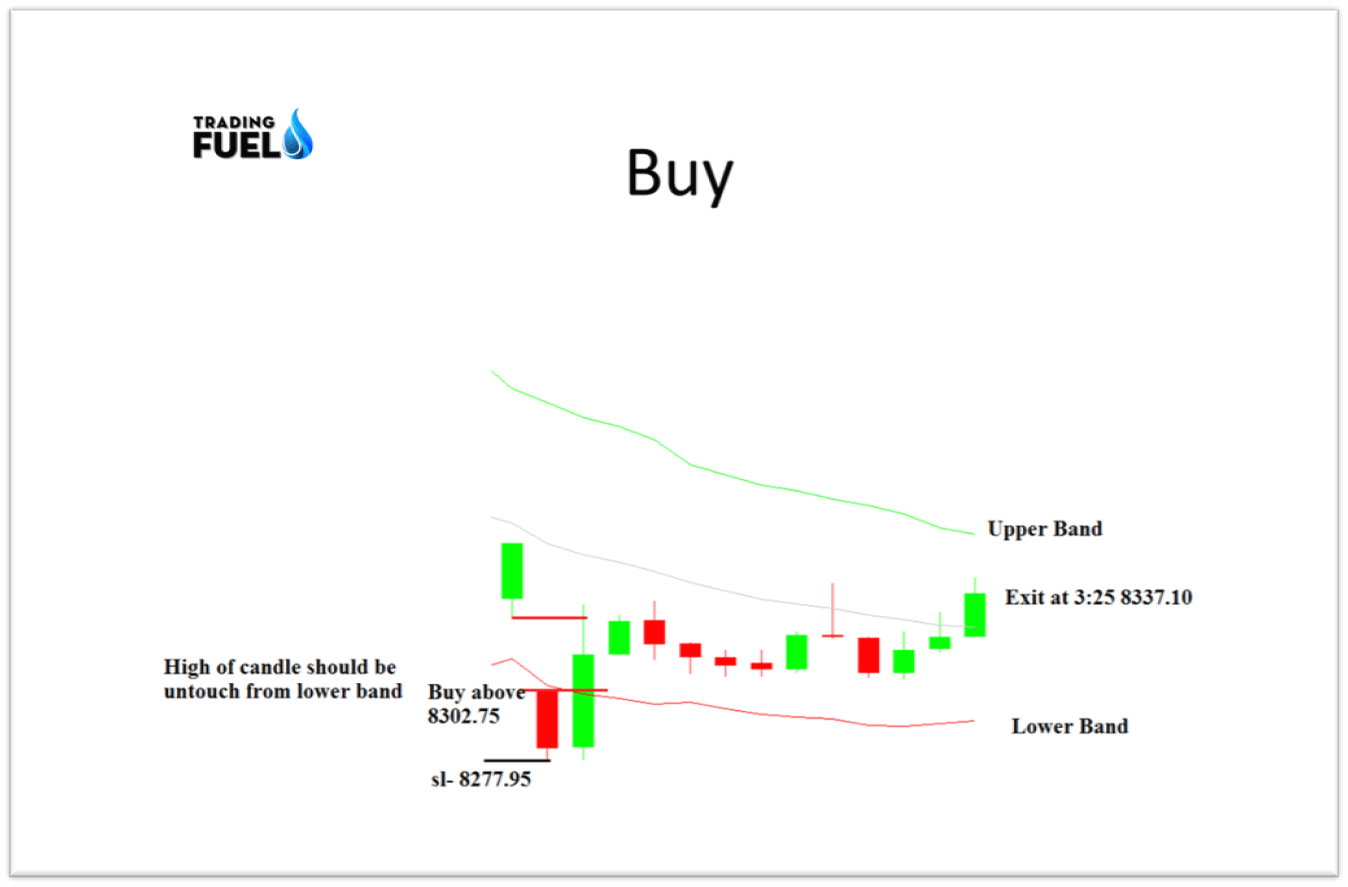

Example for Buy Trade:

- In this strategy, the well-worn should be open with Gap upbound or Gap down.

- The Early 30-minute candle should be untouched from the lower band.

- Equally you can see in the in a higher place image, the first taper opens with a breach down and it is below the lower striation.

- The elated of 1st candle is besides untouched by the lower band.

- Go for bribe trade when the high of 1st 30-infinitesimal candle is a break.

- Stop-loss = David Low of the 1st candela.

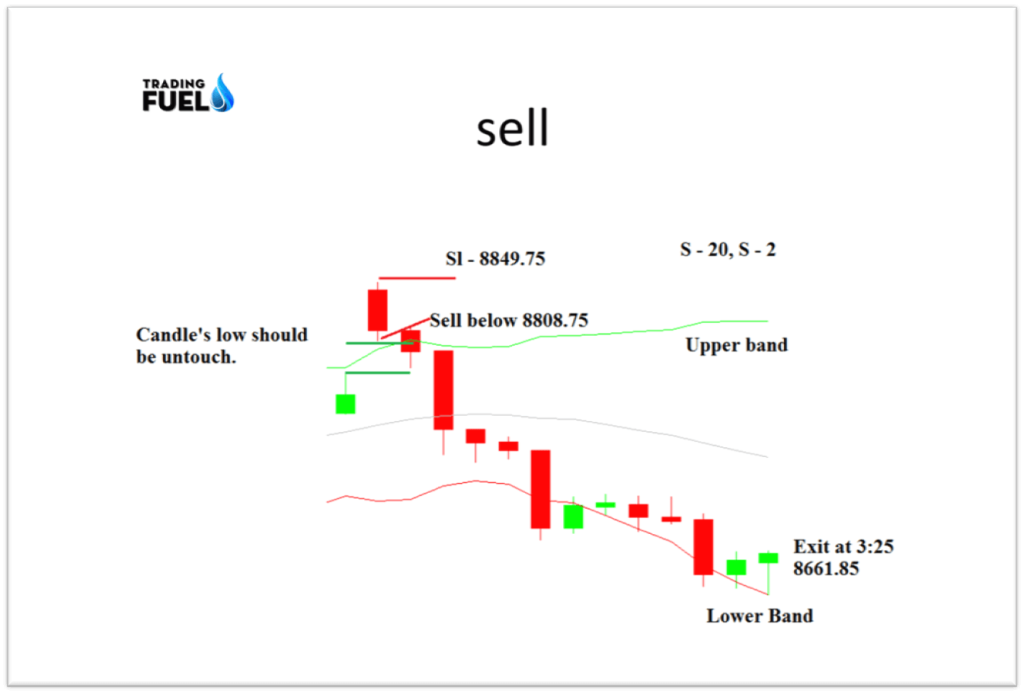

Representative for Deal Merchandise:

- The stock opens with a gap functioning and the 1st candle's low is not stirred with the upper Bollinger stripe.

- As the low of the first candle is broken, enter in to sell trade.

- Put the stop loss at the tenor of the first candle.

Note of hand: This strategy gives best result for Nifty and Bank Nifty.

# Make out About Nifty and Bank Nifty

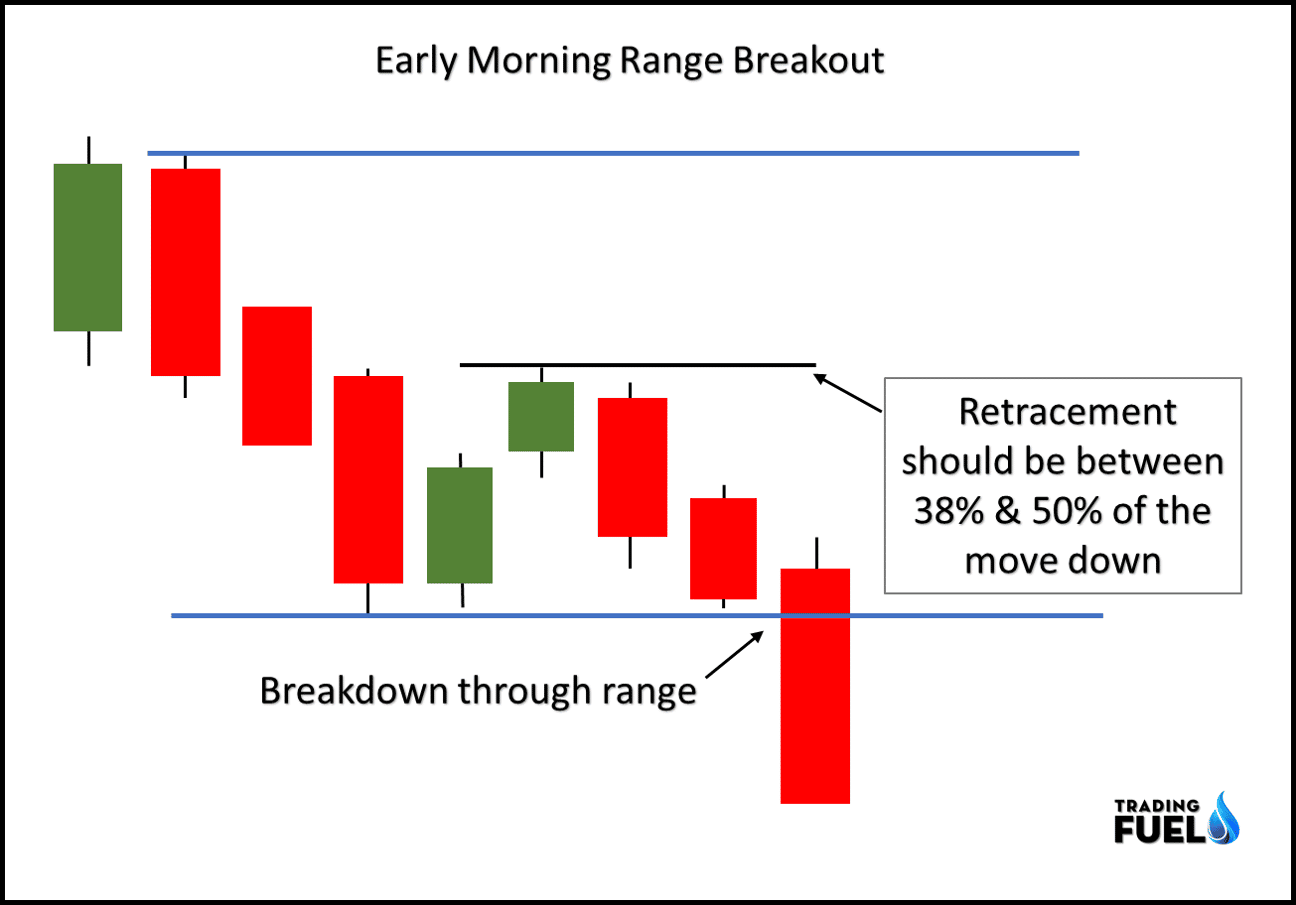

Intraday Trading Strategy #3. Morning ORB

The early break of day range breakouts are also known as opening range breakouts. It is like boodle-butter for many trades. The trading inaugural range takes skill and drill until you can profit.

The early morn run breakout assist traders to capitalize of the violent action from the flurry of buying and selling orders when the market opens.

Trading Range

The first 20 to 30-minute trading range is suitable for an opening range breakout. Piece you start trading practice using this strategy, it is recommended to part with with a very little amount of capital.

The stock you pick out for the trade should Be inside a range, which is smaller than the intermediate daily range of mountains of the stock. The upper and lower boundaries of the range give the axe be identified by the high-altitude and lowset of the offse 30 or 60 minutes.

Early Morning Range Breakout and Intensity

The idea for go short on a pause down the stairs or X long on a break higher up resistance is not that easy as you think. First, you need to understand the relationship between volume and price.

Volume and Price moldiness be in harmony. When you short Oregon long a line of descent, which has happed down Beaver State gapped finished it essential open with heavy volume and then reconstruct on lighter volume (indicating a lack of buying). Which confirms that sellers/buyers are in mastery.

Volume Is very important for all case of breakout which confirms the breakout before entry. If the stock Mary Leontyne Pric breaks the morning Support/electrical resistance level with low volume, at that place is a high chance of a false breakout.

The mental image below explained that high volume during a breakout is likely to push price through key resistance.

In this 5- microscopic chart, you see that after a break of early daybreak resistance with high volume, the price starts increasing.

Book is very tricky so you penury to be able to predict the support/resistance levels accurately ready to get wind right volume breakouts and set proper profit targets.

Disclaimer: The Intraday Trading Strategies discussed therein blog is for education propose only. We are not responsible any Profit or Exit you made victimization these strategies. We hope that you like our blog post on Intraday Trading Strategies.

FAQs happening Intraday Trading

#1. What is the best strategy for intraday trading?

Ans. News based trading is the best strategy for intraday trading. For the latest News connected Stock Market, you pot visit Money control or Bloomberg Websites.

#2. What is the easiest sidereal day trading strategy?

Ans. Early Morning Mountain chain Breakout and Loudness is the easiest day trading strategy. To learn, read Topic atomic number 102.3.

#3. What is the go-to-meeting scheme for intraday trading in Cant Good?

ANS. The best scheme for intraday trading in Bank Nifty is Gap Up and Gap Down Breakout Strategy. It's will pay you 150 to 200 Points equally the world-class quarry. To Learn, Chink on this web log https://www.tradingfuel.com/intraday-trading-techniques/

#4. Which package is advisable for intraday?

Autonomic nervous system. The number of FREE and PAID software for sale for Live Chart. For much detail, you can read this blog: https://WWW.tradingfuel.com/champion-intraday-trading-software/

#5. Who is the richest daytime trader?

Ans. George IV Soros is the richest day trader. His Estimated mesh Worth over $20 one million million.

Free of charge Live Chart

Contain danamp; Image ©️dannbsp;Right of first publication By, Trading Fuel Research Lab

professional trading strategies book live trader

Source: https://www.tradingfuel.com/best-intraday-trading-strategies/

Posted by: bojorquezstentartudge.blogspot.com

0 Response to "professional trading strategies book live trader"

Post a Comment