Forex Iq Option - Estratégia

7 min read

Trading: the act of buying and selling financial positions like spot Forex, is but a modest part of what information technology takes to exist successful every bit a trader. Anyone can sign up on a broker, open an business relationship, fund some coin and merchandise it abroad. Successful traders take a different route, a route in which the trade is just about the last matter they practice. This post lays out in a stride past step fashion the beefcake of a winning strategy.

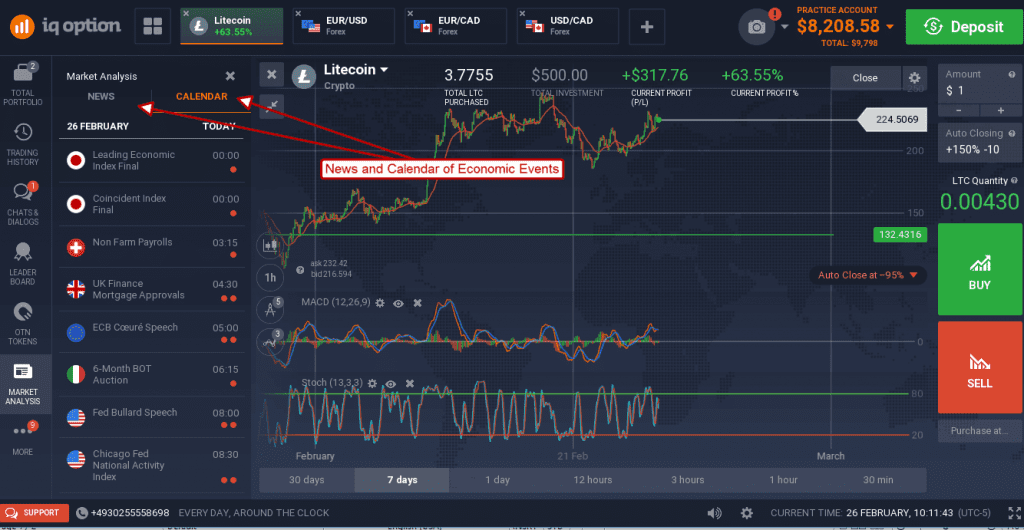

The Fundamentals – I know many people engaged in Forex are strictly technical traders but let me tell you, the fundamentals are of utmost importance. If y'all are watching a chart of price action, that action is driven by the underlying primal conditions of the market. Information technology only makes sense that if you take a grip on what marketplace weather are you volition have a amend time reading the charts. If you aren't keeping up with the economic news on a regular ground you should exist — it's a dandy source for trading opportunities and the beginning of any successful deal.

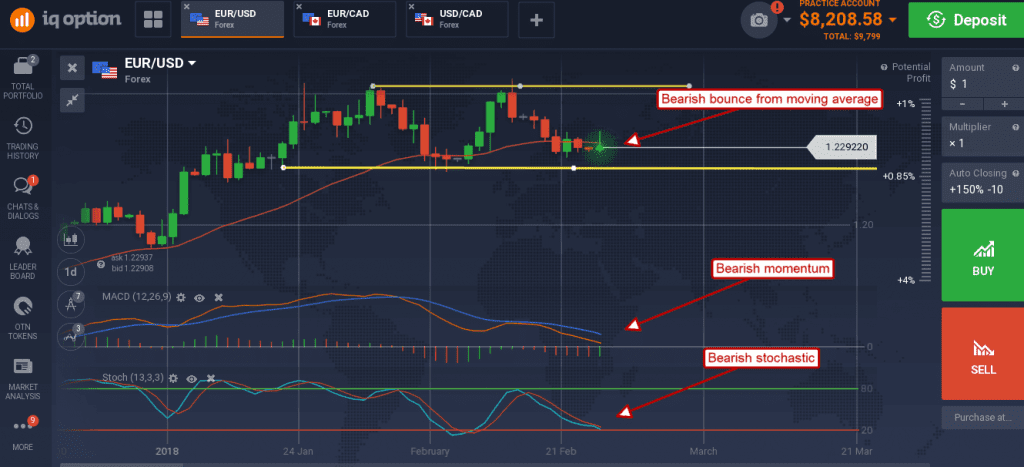

The Technicals – The technicals are the charts, the indicators, the trend lines, support and resistance; toll action and how you read them. If there is one affair I take learned time and time again is that commonly accustomed technical signals are ridiculously authentic. Why? Considering they are generally accepted, a lot of people use them, then many that information technology becomes a kind of self-fulfilling prophecy. The charts say one thing, and so people exercise what information technology says so information technology happens. Learn the technicals, utilise them to the fundamentals and you lot'll begin to recognize the profitable entry and exit points.

Strategy – Strategy is extremely important because it gives a baseline for success. A strategy is a systematic arroyo to solving a trouble. The Oxford dictionary defines strategy as "a program of activeness designed to achieve an overall goal". The overall goal is to make coin with Forex; the strategy is the program to achieve it. If things don't become according to the plan, you go back and notice out what part of the plan bankrupt down, set it, and exam information technology all over again. A good strategy will include both the fundamental and technical analysis but also specific rules for when to enter and go out a trade. For instance, certain traders make the following assumption: in an uptrend just have entry on stochastic bullish crossover when price is bouncing from a moving boilerplate. Consider the chart below.

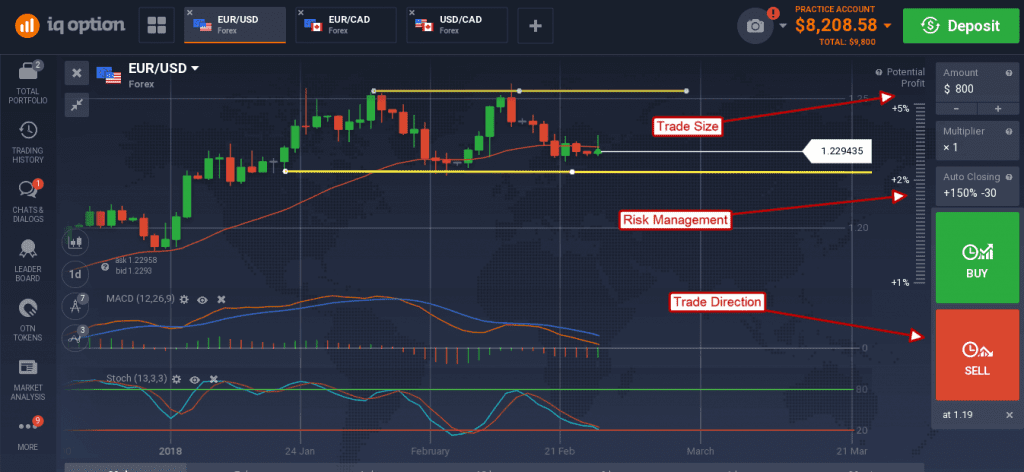

Risk direction – Successful traders always know exactly how much they are going to place on the next trade, no questions asked. This is because they utilize some course of risk management that prevents them from the dangers of trading and so much that one merchandise, or even a string of losing streaks, could wipe them out. Some traders use a Percentage Dominion. This means they only take chances a fixed, fix percentage of the account on any trade. This way, if the rule is for 3%, the amount of money that is placed on each merchandise will grow as the account grows simply will never be too large for the account to handle if the trade goes bad.

Place the trade – This role is smooth sailing if the first iv conditions are met. You will take started from a solid foundation, used it to make a good analysis, waited patiently for the right signals for entry and are trading just the right corporeality, not too much and non too little. At this betoken all you accept to do is enter your gild, execute, and wait to run into what happens.

Monitor the trade – Even with risk management and stop-losses it is a expert idea to monitor what is going on. You may desire to accept profits early if news is not what you wait or choose to raise your profit targets if price activeness looks proficient.

Close the trade – The lesson that I learn repeatedly is that y'all do not make coin until you shut the deal. Even if information technology means closing a bad trade at a loss, it is improve to save a little than lose it all. At the aforementioned time, yous might want to keep a winning position open, giving the profits an opportunity to abound.

Practice it all once more – If you are doing it right, you volition notice that your average win is greater than an average loss. Annotation that a winning strategy may need a revision once in a while, equally in that location is no ultimate trading strategy.

Merchandise now

Source: https://blog.iqoption.com/en/anatomy-of-a-winning-forex-trade/

Posted by: bojorquezstentartudge.blogspot.com

0 Response to "Forex Iq Option - Estratégia"

Post a Comment