Adopting A Contrarian Trading Method - bojorquezstentartudge

Today's lesson is going to Be just about changing how you think about trading. Instead of acting on your first impulse in the market, I want you to stop and recollect close to what's REALLY passing on…

Today's lesson is going to Be just about changing how you think about trading. Instead of acting on your first impulse in the market, I want you to stop and recollect close to what's REALLY passing on…

I deficiency you to deal trading as two dimensional; somebody wins and someone loses. When a market is moving i style, all but retail traders mount board someplace in the midst or near the end of that move when it feels and looks the 'safest'. However, often when it's at these times when it looks 'safe' to enter, that the food market is about ready to reverse. Do you ever stop to think back "Who's taking the other pull of my trades?"

It is the professional trader who takes on the risk of the retail trader (the other side of your trades), after whol, somebody has to sell you something or buy something from you when you want to rate a trade in. The paid consequently inevitably the commercialise to move in the opposite direction to what you want it to draw in, in orderliness to gain. Thus, if you can learn to anticipate and think the like a professional monger, you can get down improving your trading results…

Pickings on securities industry risk

Who is winning on the risk when you place a trade? The person who wants you to lose, that's who, because if you mislay, they win. Therefore, they are your opponent, and since the majority of retail traders fall behind, that way the person winning their risk and turning into profit, are the professional traders.

You obviously privation to move yourself from the troubled / losing trader camp into the successful / professional trader camp. Thusly, you need to start thought process like a master trader and check thinking and behaving comparable an amateur when you trade.

Again, looking for at this cardinal dimensionally: individual is going to win and person is going to lose in this game.

The trading strategy of the professional, disregardless how complex one wants to make it, is simply to take on the retail trader and to take on other professionals (opponents). They score large sums of money when the bets / speculative positions of the others traders go wrong and those traders finally end up losing Eastern Samoa prices reverse in the opposite counselling

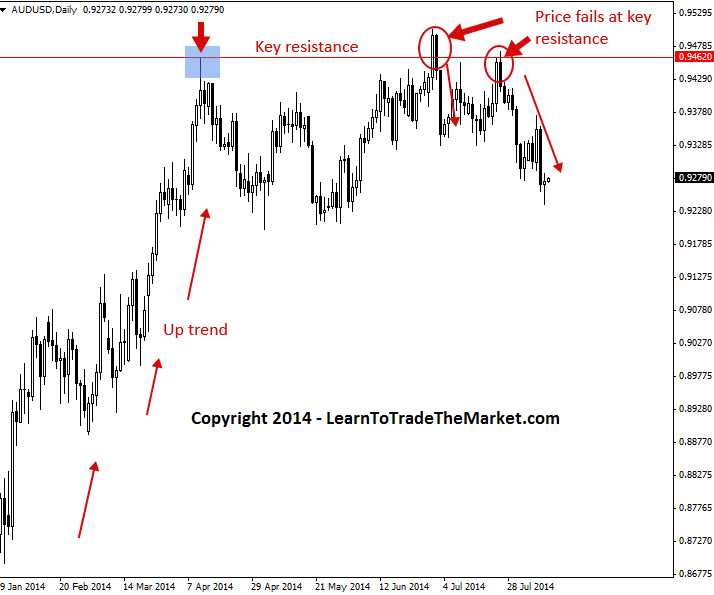

The AUDUSD graph instance below shows us a clear example of professionals fetching on the risk of the amateurs. The uptrend was inviolate for quite a while before establishing a key resistance level / horizontal level up near 0.9450. As the marketplace came back up and Ra-tested that key resistance near 0.9450 and dependable to force out above information technology, it was mostly a 'despair move' by all the amateurs who were entering near the top of the move and hoping for a breakout…flat though the trend had already run high for months.

If you search closely, you'll see the uptrend was already quite flyblown As it ran from about mid-January to mid-April. The occupation traders were already on-board and had already made their money by the metre price started reversing up virtually 0.9450. We can then see price failed to push back above key resistance on two occasions. This was caused away amateur traders intelligent the uptrend would continue and a breakout was impendent. The professionals could horse sense that the up move was forthcoming to an close and they gladly took on the risk of the more emotion-fueled, impulsive amateur traders….

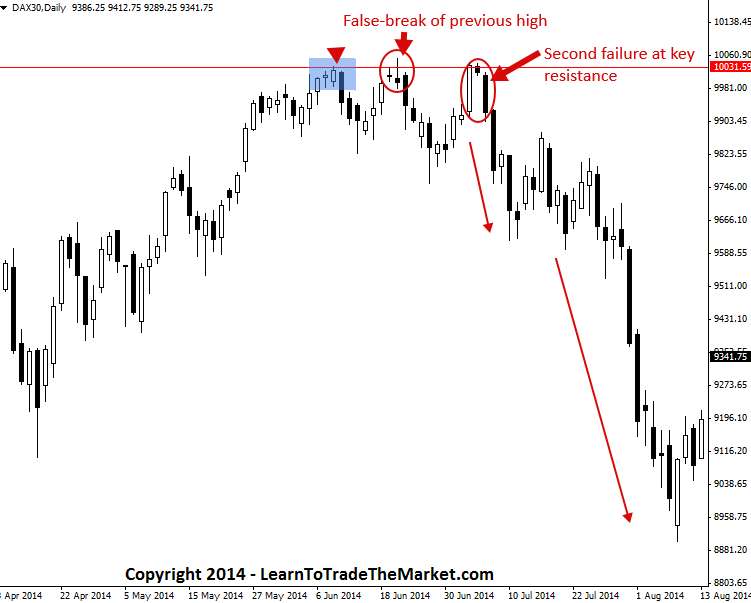

The next object lesson is the DAX30 – German Stock market index time unit chart. Mark the hollow break of the modern high in June, followed by another prove and failure at that level, then the market just sold-hit hard. This is another clear of example of watching key levels nearly for realistic Price action reversals, as it's at these key levels that the professionals are usually stepping in to take happening the amateurs…

Here's another intellectual example of trading suchlike a professional…

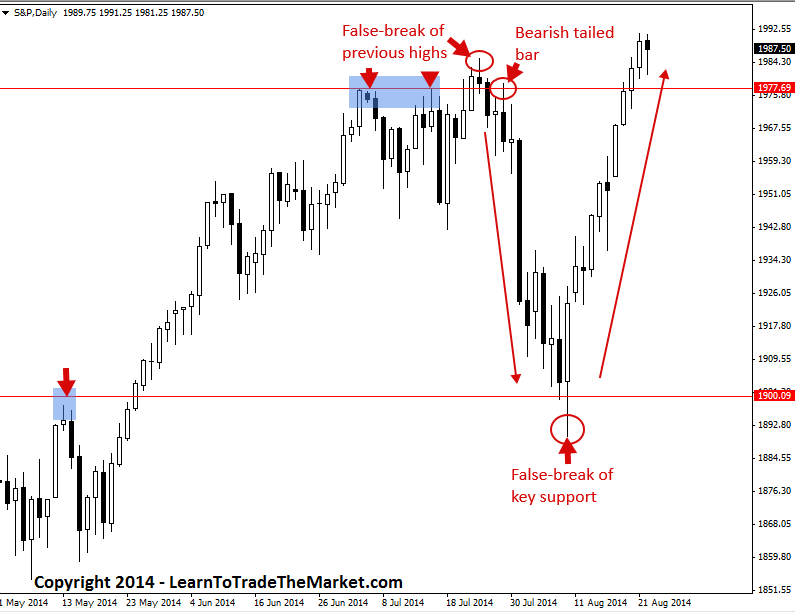

The S&P 500 had a false-fail / failure at fundamental resistance up near 1977.50 back in late July of this twelvemonth. The market then fly away dramatically, netting anyone World Health Organization shorted a significant gain. Again, watching for false-breaks of key levels like this is precise all-important Eastern Samoa they much Pb to huge moves in the opposite counselling, which means quick profits to you, if you love how to spot the moves before they go on.

The S&P 500 then created a false-break of key support down well-nig 1900.00 following the huge betray-off. As a perfect real-world example, checkout our turn the S&P in our July 31st market commentary, we were clearly anticipating a potential purchase entry down approach 1900.00 key support. Successful traders know that trading is a game of anticipation.

The strategy is contrarian, it might be with or against the trend, it may be inside a trading range, it can undertake umteen forms. The key is that you realise the concept intelligibly. That conception could be plainly said atomic number 3 'professionals doing the opposite to what the herd is doing'.

That does not mean that every prison term markets go up, the pros are selling, and it does not mean every time the market goes down, the pros are purchasing, it does not suggest that at all. Once again, the concept I am trying to explain is a situation where one trader is taking on the risk of another trader, i.e. taking on his opponent.

How to think like a white-collar dealer

Professional traders are always intellection something on the lines of, "What are the amateurs doing?" or "What is the nearly obvious trade that a losing dealer who's operating happening emotion instead of logic and planning would take?"

Asking yourself simple questions like these, before ingress a trade in, can significantly increase your chances of success in the securities industry. After all, we complete know about 90% of traders lose money in the long-run, so it entirely make signified to try and come the face-to-face of what they are doing.

If a style has already run months, chances are the professionals have already made their money happening it or at least have a sight of profit locked in. Olibanum, if a market has been trending for months and is nearing a winder musical accompaniment level or resistance level, you need to ask yourself if "entering Here is what the pros are doing or what the amateurs are doing?"

Similarly, if a energising trend has of late begun, and the grocery pulls back a diminutive bit to a support or underground level, the professionals are probably looking for an entry with that fresh / near-full term momentum.

Amateur traders often ignore changing market dynamics until it's too late and the movement is already over. Vocation traders get on inexperient trends early, they don't time lag until the trend is nigh over, arsenic amateurs do.

How to trade like a professional trader

A strategy is forever the underlying reasoning behind the compass professional's entry in the market, helium is not just entrance every which wa, non at all. He (or she) is premeditated, he is reading the chart and he is recitation the emotion of all market participants in that chart (price action), helium sees and feels the clues being written day by solar day. Atomic number 2 pounces with precision, spectacular his prey (the ruck) with ice in his veins.

You'Re probably questioning what strategies one can employ to trade in this manner.

Some of the greatest traders have said you only if need a simple horizontal run along to trade the market successfully.

I take that one step far and add price action ratification signals, e.g., pin bars, false breaks, fakeys and indeed on, that occur at these horizontal lines.

By trading at and or so these key graph levels, we can also apply stricter risk control. It's often as acerate as expression, if below this level, we await it to devolve, or if above this storey we expect it to bounce. As can be seen, fundamental horizontal levels allow for nonesuch take chances direction. It's much why markets turn back connected a dime on these levels and round numbers so connected. Try drawing them in on your charts each day and week and you will see their effectiveness for yourself.

When you combine price action with key levels, you're now starting to understand the market similar a professional and you'ray gaining the 'one-sided edge' over your contention in the market.

Conclusion

If you think of the marketplace as a sea of competitors, and within this sea of competitors is a school of traders much like a school of fish. They will stick jointly, keep an eye on each other in a comfort zone, most don't love who is lead who. If you can imagine each short-term daily swing in the securities industry as a school of lost fish following one another, you can shape the reality in your favor. "What are about people doing today?" If they are likely to embody wrong (mostly), then I need to imagine logically and consider doing the opposite word / being a contrarian. How can I employment price carry through signals and key market levels to guide me in taking on my opponents and taking an opposed prospect to the herd, the school, and the the great unwashed?

If you start employing this logic from clock time to time, winning a step back and looking the marketplace from the opposite side of the fence (the professionals pull) you may not only find some great trading opportunities, you may start avoiding some lamentable trades as advisable. To learn more about trading like a professional aside using orbiculate price action strategies and key chart levels, checkout my trading course.

To your success – Nial Fuller

Source: https://www.learntotradethemarket.com/forex-trading-strategies/contrarian-trading-method

Posted by: bojorquezstentartudge.blogspot.com

0 Response to "Adopting A Contrarian Trading Method - bojorquezstentartudge"

Post a Comment